In an effort to provide student loan relief without encountering the legal hurdles that thwarted previous attempts, President Biden’s administration has unveiled a new proposal. This tailored approach is designed to offer targeted relief to specific groups of borrowers, learning from the setbacks of the 2022 universal forgiveness plan that was struck down by the Supreme Court.

Understanding the New Proposal’s Focus

Unlike the broad strokes of the 2022 initiative, the current proposal aims to concentrate relief efforts on distinct borrower demographics, potentially increasing its viability in the face of legal scrutiny. Katharine Meyer, a fellow at the Brookings Institute’s Brown Center on Education Policy, highlights this strategic shift. She notes that while the previous plan proposed widespread debt cancellation, the new strategy is more nuanced, focusing on those who might benefit most from targeted relief.

Key Features of Biden’s Debt Relief Plan

The administration’s plan, introduced last Monday, seeks to address several specific borrower situations:

- Income-Driven Repayment (IDR) Plans: Borrowers who have adhered to IDR plans but faced bureaucratic obstacles may see full forgiveness. This group represents a significant portion of those impacted, addressing fairness for those who have consistently attempted to manage their debt responsibly.

- Long-term Borrowers: Those who have been paying on their loans for over 20 years could see additional relief, recognizing their prolonged financial commitment.

- Attendees of Low-Financial-Value Institutions: Targeting relief towards borrowers who attended institutions that failed to provide a substantial financial return on their educational investment.

- Borrowers Experiencing Hardship: Specific measures are considered to help those facing significant financial difficulties.

- Unpaid Interest Growth: This is the largest group affected, with around 25 million Americans potentially receiving partial or full forgiveness of accrued interest, which often represents a substantial barrier to loan repayment.

Implementation and Timing

The proposed changes are set to be fleshed out over the coming months, with the Biden-Harris Administration planning to release detailed rules. If these plans proceed as intended, implementation could begin as early as this fall, involving the cancellation of up to $20,000 in interest for millions of borrowers and complete loan forgiveness for millions more. This prompt action contrasts sharply with the timeline of the 2022 plan, which was mired in delays and ultimately fell through.

Meyer suggests that the administration may expedite the implementation process by invoking a “good cause” exemption in the administrative rulemaking provisions, allowing some regulations to take effect sooner than typically permitted.

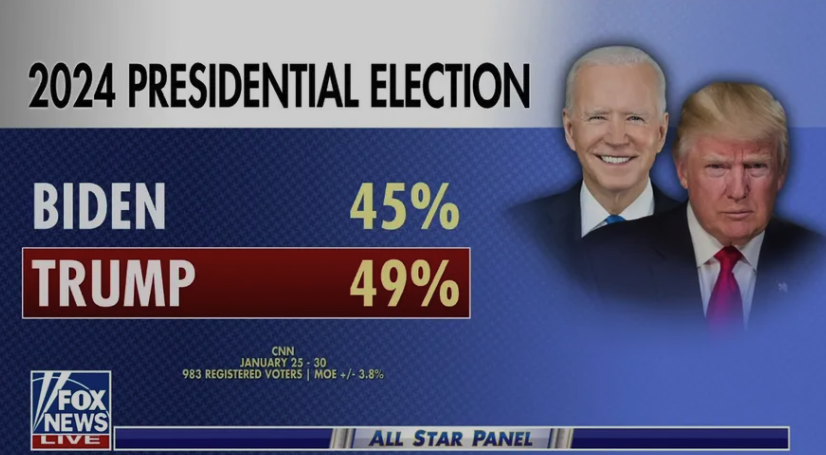

Legal and Political Considerations

The timing and structure of the new proposal are critical, as fears persist that student debt relief could be promised only to be retracted near Election Day, a concern stemming from the timing of previous initiatives. The administration’s approach seems designed to mitigate these fears by offering a clear, phased rollout and focusing on regulatory adjustments that could withstand legal challenges.

Expert Opinions and Effectiveness

Legal and educational experts agree that if the relief is implemented more swiftly and effectively than in previous attempts, it could significantly alleviate the financial burden on millions of Americans. By learning from past missteps and focusing on targeted relief, the Biden administration hopes to create a durable and legally sound framework for student debt forgiveness.

Conclusion

President Biden’s new student debt relief proposal represents a strategic pivot from past policies, focusing on targeted forgiveness to help those in greatest need while navigating the complex legal landscape that has hindered broader relief efforts. As the details of the plan are hashed out and the proposed rules are set in motion, borrowers and political observers alike will be watching closely to see if this approach can deliver the promised relief without encountering the legal pitfalls that have plagued earlier efforts. This tailored approach may not only offer immediate financial relief to millions but also set a precedent for how educational debts are managed on a policy level in the future.