Once upon a recent time in the bustling corridors of Congress, a tax relief bill emerged from the House, swaying gracefully to the rhythm of bipartisanship. This wasn’t just any piece of legislation; it was a $78 billion choreography that had lawmakers from both sides of the aisle moving in a rare, harmonious sequence. But as this bill pirouettes its way into the Senate, it’s about to face the music in a whole new way.

Imagine, if you will, the Senate as the ultimate dance-off arena, where the Senate Republicans, led by their Whip John Thune, are eyeing this incoming dancer with a mix of awe and skepticism. “Most of the problems have been on the [child tax credit side],” Thune observed, like a seasoned dance critic wary of a new performer’s untested moves. He’s not alone in his critique; the GOP ensemble is concerned that this bill might just be stepping on the toes of fiscal responsibility, especially with its expansion of the child tax credit and its potential to invite a nearly $400 billion waltz with the federal deficit over the next decade.

But let’s not forget about the masterminds behind this choreographed effort: Senate Finance Committee Chair Ron Wyden and House Ways and Means Committee Chair Jason Smith. Their bipartisan pas de deux has been nothing short of a Capitol Hill sensation, even if it means making some in the Senate feel like wallflowers at their own party.

Meanwhile, Speaker Mike Johnson, from the House’s corner, has been singing praises for the bill, calling it an “important bipartisan legislation to revive conservative pro-growth tax reform.” Yet, Senators like Thom Tillis can’t help but scratch their heads, puzzled by the House’s enthusiasm for a bill that might extend benefits to migrants being paroled into the country. “Why that would be lost on Republicans in the House [is] just shocking,” Tillis mused, echoing the sentiments of a dance judge questioning a bold new step.

As the bill twirls into the Senate spotlight, amendments are the talk of the town. Thune and his fellow Republicans are calling for a chance to tweak and twirl the legislation to their liking, hoping for an open amendment process on the Senate floor. Without it, Thune warns, this tax relief tango might not find the partners it needs to advance.

The House’s rendition of the Tax Relief for American Families and Workers Act may have swept through with a standing ovation, passing overwhelmingly, 357-70. Yet, the Senate’s GOP buzzsaw stands ready, questioning the bill’s fiscal footwork and its impact on migrants, deficits, and the economy at large.

Senator Mitt Romney, always keen on fiscal choreography, voiced his concerns about the bill’s long-term costs, likening it to an expensive dance routine that the country might not be able to afford. “Adding more and more spending is getting us deeper and deeper into a hole that’s going to be hard to ever get out of,” he cautioned, like a worried dance instructor eyeing an overambitious routine.

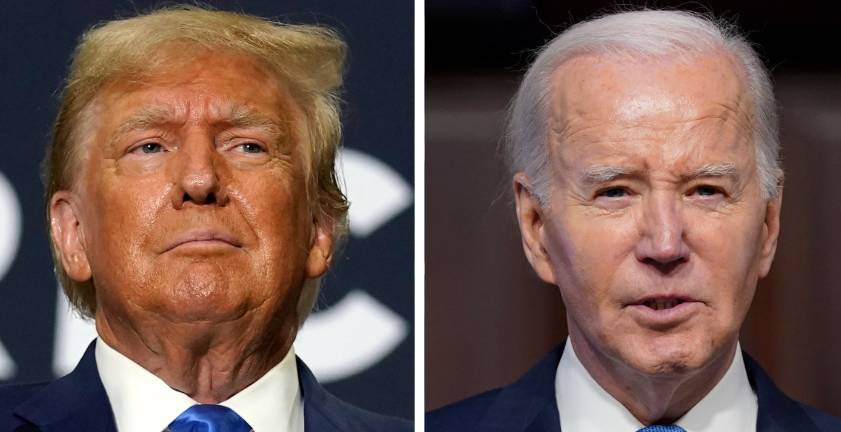

Wyden, however, remains unfazed by the critiques, defending the bill’s composition and its alignment with past Republican performances, including those under the Trump administration. “The language here is exactly the language that was the law six years ago with the Trump tax bill,” he asserted, ready to defend his choreography against any naysayers.

As this tax bill tango unfolds, the Senate prepares for a dance-off that could either elevate the bill to new heights of bipartisan glory or see it stumble under the weight of skepticism and critique. One thing’s for certain: in the grand ballroom of Congress, the music never stops, and the dance goes on.