Welcome to the latest episode of “As the Economy Turns,” where the Federal Reserve plays the lead role, Wall Street and Washington are the eager audience, and the rest of us are trying to keep up with the plot twists. In this week’s installment, the Fed has decided to keep us all on the edge of our seats by holding interest rates steady, making it clear that those hoping for rate cuts will have to wait a tad longer.

The Scene: A Pivotal Moment

Picture this: The central bank’s policy-setting committee gathers, the economic landscape as their backdrop. Employment and consumer spending, the darlings of the economy, are showing signs of a slow dance rather than their usual upbeat tempo. Inflation, the antagonist in this drama, is being lured back to its 2 percent lair, but the Fed wants to be absolutely sure it’s not just a trick.

The Plot Thickens

Fed Chair Jerome Powell steps into the spotlight, delivering the line everyone’s been waiting for – but it’s not the cue for rate cuts that some were hoping to hear. Instead, Powell signals that the committee’s confidence in taming inflation needs to grow stronger before they even consider such a move. It’s like waiting for the season finale of your favorite show, only to find out it’s been delayed.

Economic Highs and Lows

Amidst this suspense, there’s a subplot worth noting: the economy’s resilience. Despite the Fed’s aggressive moves to increase borrowing costs (cue the dramatic music), the economy has been a trooper, with growth and inflation rates playing their parts convincingly. Yet, whispers of a slowing labor market and consumer caution suggest that not all is calm in the kingdom.

A Chorus of Voices

In the wings, a chorus of White House allies and lawmakers are softly chanting for quicker action, hoping to sway the Fed’s script. They’re like the side characters who sometimes steal the scene, with their concerns about housing affordability and the dream of a balanced economy where everyone thrives.

A Twist in the Plot: Housing Market Dynamics

Enter the housing market, a subplot that’s become intertwined with the main story. With mortgage rates high up in the balcony, there’s a debate about whether lower interest rates would be the hero or villain of this tale. On one hand, they could make homeownership more accessible; on the other, they might just fan the flames of rising home prices in a market starved for inventory.

The Fed’s New Policy: A Subplot of Trust

In a related development, the Fed announces a tightening of conflict of interest policies, a subplot born from a trading scandal that previously shook the central bank’s foundation. It’s a move toward transparency and trust, reminding us that even those in the highest towers must adhere to the kingdom’s laws.

To Be Continued…

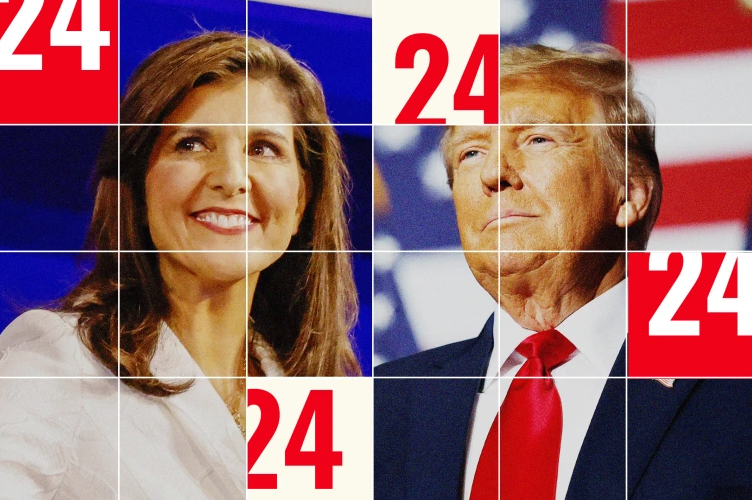

As this episode of “As the Economy Turns” draws to a close, we’re left with more questions than answers. When will the Fed lower rates? How will the economy respond to the central bank’s maneuvers? And, crucially, what does all this mean for the presidential election looming on the horizon?

Like any good drama, the story of the Fed and the economy is full of complexity, suspense, and a cast of characters each with their own motivations. As we wait for the next episode, we can only speculate, analyze, and, of course, stay tuned. So, grab your economic popcorn, folks – this series is far from over.